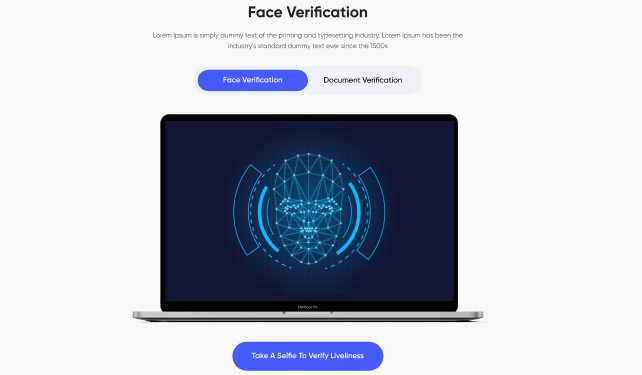

Confirms user presence by analyzing real-time facial movements to prevent fraud.

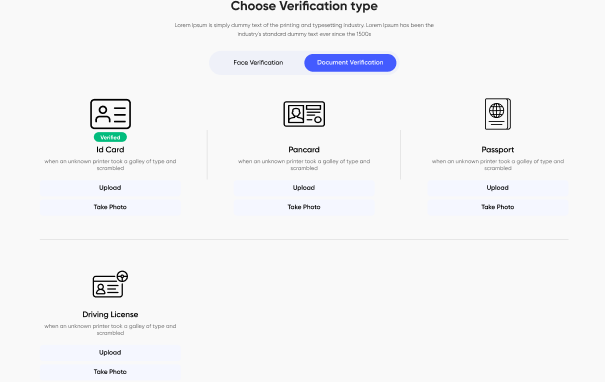

Try Face Liveness DetectionAutomates checks against government databases to confirm document authenticity and security features.

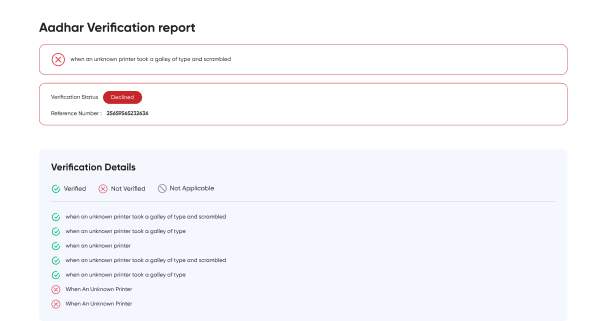

Try Identity Document VerificationOffers detailed analytics on KYC processes, enabling customizable reports for enhanced oversight

Try In-Depth ReportingScreens customers against global watchlists to identify risks and ensure regulatory compliance.

Try Watchlist ScreeningMonitors transactions for suspicious activities related to money laundering, ensuring regulatory adherence.

Try AML ScreeningThe Know Your Customer (KYC) process is a crucial part of verifying the identity of individuals and ensuring compliance with regulatory requirements

The user initiates the process by taking a selfie or uploading a picture for facial recognition.

The user then uploads a required document (e.g., ID, passport, etc.) for verification.

A report is generated by cross-referencing the user’s information with a government database, ensuring accuracy and validity